by Aaron Dietrich, Tolomatic

Calculate product yield and utility and maintenance costs for a technology’s service life, and do it early in the process of specifying equipment.

Pneumatic-cylinder actuators are durable with low initial cost, so have been a staple in factory automation equipment for decades. They are simple, easy to maintain and provide reasonable control over moving axes in industrial plants. However, since the development of more flexible and reliable electric actuators, there’s been ongoing debate over which technology offers the best overall actuation for industrial plants.

The case for switching to electric actuators usually focuses on how motor-based linear motion controls position, speed, acceleration and force with more accuracy and repeatability.

The truth is that electric actuators have both higher performance and initial cost. However, in this article, we’ll list factors that make electric actuators more economical than air cylinders over the machine or device life. We define total cost of ownership (TCO) as the initial purchase cost + years of service—multiplied by yearly replacement costs + yearly maintenance costs + yearly electric utility costs + yearly product scrap + yearly lost production due to changeover time and cycle time.

Background on the term TCO

TCO is a corporate buzzword and many large companies have initiatives to lower TCO within divisions or product lines. Yet departments have varying goals and some don’t view operations from a TCO perspective. For example, corporate purchasing’s goal may be to negotiate the purchase of capital equipment with the lowest initial price. Plant engineers and maintenance personnel focus on personnel’s technology expertise so they can get equipment back up and running after problems arise.

Plant management may have the most holistic view of equipment TCO because they manage capital equipment and operations budgets. Yet it’s common for plant management to anguish over the higher initial cost of electric actuation.

Ignoring TCO certainly lowers short-term equipment cost, but comes with increased utility costs and maintenance with lower product yield over the long run. As we’ll see, if more manufacturers truly embraced the TCO concept, more would choose electric actuators over equipment run on compressed air.

How to determine efficiency and electric-utility costs

An internet search for pneumatic-system efficiency returns a long list of studies and reports. Almost all concentrate on efforts to make pneumatic systems more efficient. That’s admirable, but there’s little mention of improving overall efficiency by decreasing electricity consumption with non-pneumatic actuation.

“Compressed air is one of the most expensive sources of energy in a plant. The overall efficiency of a typical compressed air system can be as low as 10 to 15%.”— U.S. Department of Energy: Energy Tips-Compressed Air, August 2004.

“Only 23 to 30% energy efficiency is achieved for pneumatic systems, against 80% for electrical systems and 40% for hydraulic systems.”— British Fluid Power Association: New developments and new trends in pneumatics, FLUCOME Keynote lecture 2000.

“According to the study, Compressed Air Systems in the European Union (Radgen and Blaustein, 2001), 10% of the total electricity consumed in the the EU-15 by industry went to the production of compressed air. The electricity consumption of CASs (compressed air systems) in Chinese enterprises goes from 10 up to 40% (Li et al., 2008) of the total industrial electricity consumed.”— European Union Motor Challenge Problem study on Increasing Energy -Efficiency in Compressed Air Systems, Radgen and Balsten, 2001.

What do these statements on pneumatics mean?

For most applications with linear motion, the main difference between electric and pneumatic systems is disparate electric-utility costs. Assume that pneumatic systems have an average efficiency of 20% and electric systems have an average efficiency of 80%. With pneumatics, efficiency can vary from 10 to 30% depending on air quality, seal quality and wear, and leaks in system infrastructure. These factors require constant attention and maintenance, or efficiency suffers. In contrast, electric-actuator efficiency doesn’t change drastically over time.

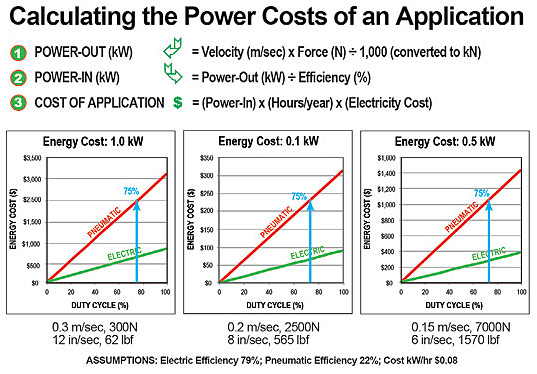

Consider pneumatic cylinders with a 1-in. (25-mm) bore, a 3-in. (80-mm) bore and a 5-in. (125-mm) bore. Simplifying the power costs of a sample application to a few formulas returns a good estimation of the electric utility cost associated with a single axis of motion:

• Power OUT (kW) = Velocity (m/sec) x Force (kN)

• Power IN (kW) = Power OUT (kW) ÷ Efficiency (%)

• Electric Utility Cost of Application = (Power-IN) X (Hours/year) x (Electricity Cost per kW-hr), assuming $0.08 per kWh

In application #1, a cylinder with a 1-in. (25-mm) bore runs at 80 psi, generating force of ~62 lbf (0.33 kN)

Speed = ~12 in./sec (0.3 m/sec)

Power OUT = 0.1 kW

In application #2, a cylinder with a 3-in. (80-mm) bore runs at 80 psi, generating force of ~565 lbf (2.5 kN)

Speed = ~8 in./sec (0.2 m/sec)

Power OUT = 0.5 kW

In application #3, a cylinder with a 5-in. (125-mm) bore runs at 80 psi, generating force of ~1570 lbf (7.0 kN)

Speed = ~6 in./sec (0.15 m/sec)

Power OUT = 1.0 kW

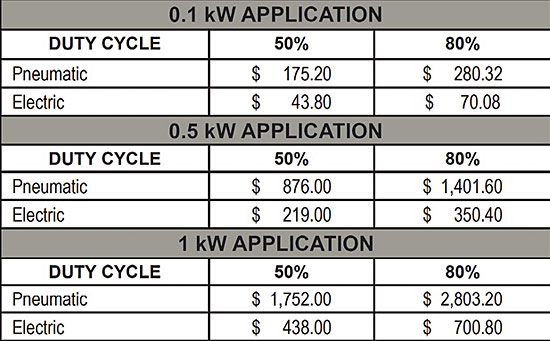

As with any device consuming electric power, the number of times the device works or cycles directly relates to the amount of electricity it uses. Therefore, duty cycle (time working ÷ [time working + time at rest]) dominates electricity-cost calculations for all actuators. Note in this article’s graphs titled, Calculating the power costs of an application, the low efficiency of pneumatic systems make energy costs rise more steeply with duty cycle.

As with most factory-automation equipment, duty cycle is normally high to maximize machine use and plant output. Refer to the table titled, Pneumatic versus electric cost comparison based on duty cycle and kW. It compares duty cycles of 50 and 80% with respect to our pneumatic-application setups. In a 0.1-kW application, annual operating costs for electric actuators are about $130 (at 50% duty) and $210 (at 80% duty) less than what it costs for pneumatic. In a 0.5-kW application, they’re $655 less (at 50% duty) and $1,050 less (at 80% duty).

More on leaks that consume electricity

All pneumatic systems or infrastructures leak. Large leaks are easier to detect and correct, but it’s hard to find small ones. In fact, the accumulation of many small unidentified air leaks can significantly increase manufacturing companies’ electric bills.

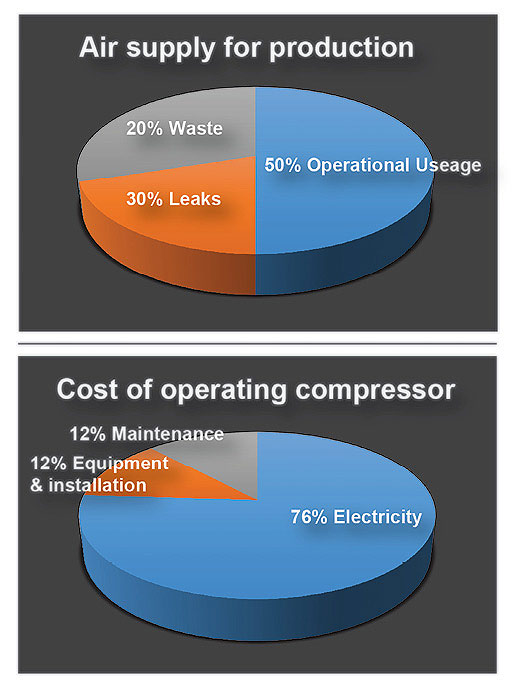

Refer to the pie chart titled, Air supply for production. This and the chart below it show real-world operational costs. According to the U.S. Department of Energy, about 30% of air supply for production is lost to leaks. Search online for the compressed air systems fact sheet for more specifics. Many estimate that the TCO of an efficient compressor is 76% electricity cost.

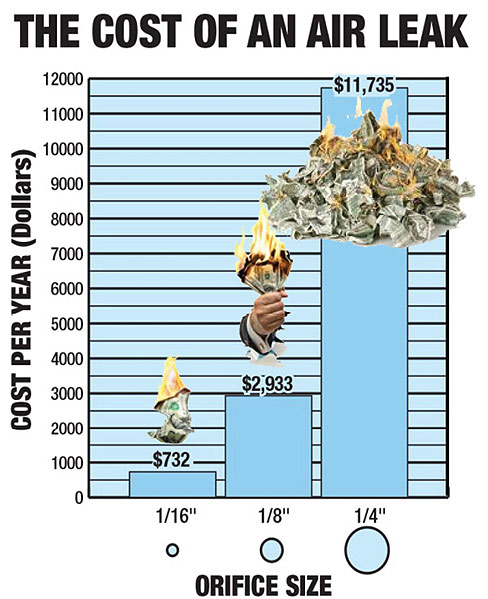

Consider the figure titled, The cost of an air leak. One leak from a ¼-in. hole can cost a facility $11,735 per year (at $0.07 kWh) in wasted electricity. Cumulative leaking during peak hours where kWh rates can vary are particularly costly.

Maintenance and replacement

Pneumatic actuators rely on tight rod and piston seals to prevent air leaks. As the actuator strokes back and forth thousands or even millions of times, seals eventually wear. If that results in a leak, it can degrade cylinder efficiency, force output, speed and responsiveness—and can even interrupt manufacturing processes. What’s worse, predicting seal failures or anticipating their effect on performance can be almost impossible.

Maintenance personnel and operators in plants can spend endless hours adjusting the flow or regulation of air into individual devices to get proper operation. Once this process begins, many plants and manufacturing facilities put pneumatic cylinders on a replacement or repair schedule to get more consistent operation. This takes time, labor and effort for maintenance scheduling and repairs—other TCO factors.

Electric actuators need little or no maintenance. Some need occasional re-lubrication, but electric actuators primarily use ballscrews and ball bearings, which let designers make more predictable estimations of service life. That’s because these components have dynamic load ratings and industry-standard ball-bearing L10 life calculations.

Get better product quality

Because cylinder performance declines as seals wear, operators may need to regularly readjust pneumatic cylinders to get repeatable or accurate performance.

Imagine a process that uses a cylinder to cut a product. It must operate at a certain speed so the edges don’t fray or rip. A

pneumatic device needs monitoring and adjustment over time by maintenance personnel or equipment operators to maintain repeatable speed. In contrast, an electric actuator executes this move at the same speed over the machine’s life without any plant-personnel intervention.

Or, imagine a process that needs repeatable force to complete a process. As seals wear and air pressure changes, a pneumatic cylinder’s force output changes … so it needs regular monitoring or adjustments. In contrast, electric actuators maintain force output over years of operation, and even outperform pneumatic cylinders under the best conditions for the latter, as electric actuators instantaneously develop force. In contrast, pneumatic cylinders must wait for air pressure to build to get the target force.

System vibration can also be a performance concern. Typically, pneumatic cylinders go in bang-bang, end-to-end applications where they move to two positions to perform machine operations. Even though cushions or shock absorbers soften vibration at the end of each move, the motion of pneumatic cylinders is often less controlled than its electric-actuator counterpart.

For example, in inspection or pick-and-place applications (where system vibration degrades measurements or causes misplaced parts) pneumatic cylinders can send shock and vibration into the mechanical structure of the equipment.

In contrast, electric actuators have full control over the motion profile (acceleration and deceleration, position, velocity and force) and can prevent introduction of shock or vibration disturbances into the system.

Machine changeover and setup time

Applications that need product changeovers and multiple setups often benefit from conversion to electric actuators—for example, machines that must accommodate different sizes of different products. Pneumatics often need rod-lock spacers on the cylinder to move to multiple positions … but adjustment of hardstops or addition of spacers on rods can be time consuming and error-prone, particularly if the installer puts the wrong rod spacers on some or all axes of motion. Where applications need hard-stop adjustments for pneumatic cylinder positioning, electric-system programming can automate this.

In fact, electric actuators simplify myriad changeover tasks. Operators can use programming to make adjustments on the fly. Electric actuators can move lower-duty-cycle setup axes or they can run high-cyclic process-important axes, thank to complete control over position and motion profiles—acceleration and deceleration, velocity and force. Usually, setup is through an HMI or batch-process file with little or no operator intervention. Every process is different, but quicker changeovers reduce the spent adjusting machines so there’s more time to produce product.

Cycle time and throughput

Consider the profitability of improving cycle time and overall equipment throughput. Pneumatic cylinders are typically deployed as two-position devices. If a process has any tooling that must move out of the way for some process, then the pneumatic cylinder’s full stroke must reach over that move.

During runtime, this means that the pneumatic cylinder must cycle back and forth across its full stroke even if it is not required for the runtime process, which increases production time. Furthermore, if the pneumatic cylinder must develop force in this process, additional delays result, because the cylinder must build up air pressure to output target force. Typically this doesn’t take long (usually tens or hundreds of milliseconds) but it is nonetheless wasted time in every cycle and it is cumulative.

In contrast, electric-actuators stroke the tooling only as much as is needed (not the full stroke) to get the tooling out of the way for the product to move into position, saving valuable cycle time. Electric actuators can also develop force almost instantaneously because their force is directly equivalent to electrical current through the motor.

Application Examples

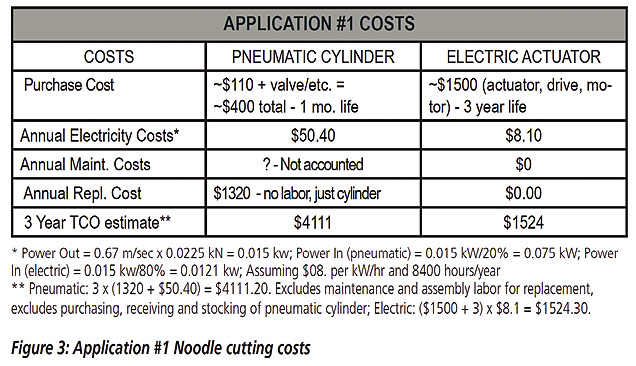

Consider two applications that show the TCO for pneumatic and electric actuators.

Application #1: Noodle cutting

Industry: Food & beverage

Requirements:

1. Stainless Steel and IP69K construction

2. Load: 5 lbf (22.5 N)

3. Motion Cycle: Move out 100 mm and back 100 mm in 0.5 sec with minimal to no dwell

Speed = 0.67 m/sec

In this real-world example, the facility replaced the pneumatic cylinder every week. Understanding this is an extreme case, the application calculation above uses a one-month preventative maintenance period where the cylinder is replaced. As stated earlier, pneumatic cylinders are commonly put on preventative maintenance replacement plans which span from one month to one year. When there’s no plan, failed cylinders cause downtime.

With a one-month life and $110 purchased cost of pneumatic cylinder, the ROI for this application is less than 13 months for an electric actuator costing $1,500 for three years of use.

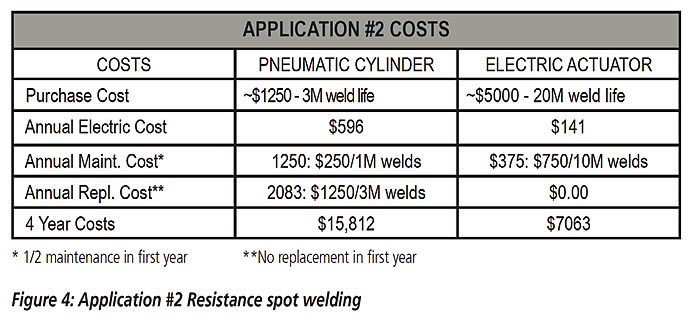

Application #2: Resistance spot welding

Industry: Automotive

Requirements:

1. Force: 1,000 to 2,500 lbf (4.45 to 11.1 kN)

2. Motion cycle: Small loaded passes (~0.25 in.) to clamp metal every 3 sec; five million welds per year

Here we compare a pneumatic actuator costing $1,250 (to last three million welds) with an electric servo-actuator costing $5,000 (to last 20 million welds). The pneumatic cylinder TCO is more than double that of the electric actuator. Considering that most automotive plants have hundreds of actuators performing welds at any given time, the cost, increased quality and performance along with maintenance savings can be substantial over time.

Tolomatic

www.tolomatic.com

great info!