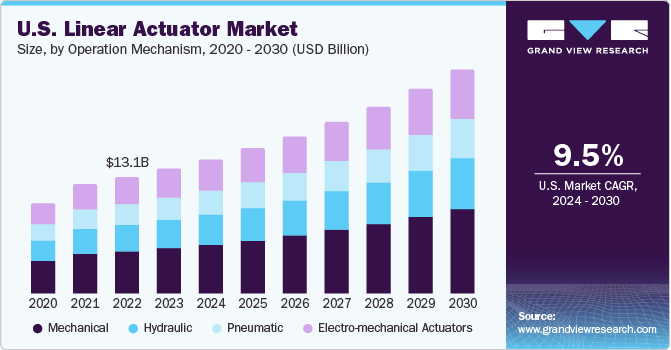

Automation over the last several years has expanded use of electric linear actuators to leverage their technological advancements in smart homes, aerospace, defense, and industrial applications. In fact, the global linear actuator market could (in large part because of electric options) surpass U.S. $52.67B this year and grow at a compound annual growth rate through 2030, according to Grand View Research.

We recently asked several industry experts what markets they see driving this adoption. The responses were diverse. Several experts indicated increased use of electric actuators and related linear-motion components in North American and European off-highway equipment and aircraft to replace hydraulics and pneumatics. Others cited the proliferation of smart actuators (integrating encoders and other feedback along with onboard electronics for controls) as key to new DX designs. Such actuators increasingly feature enhanced connectivity for streamlined commissioning, automated optimization, and predictive-maintenance functions.

Pre-engineered and integrated linear-motion variations are now commonplace in myriad industries — especially where end users require advanced subassemblies such as stages, gantries, and XY tables for captive use or application-specific electric actuators.

Rice: Machine builders save time and money by outsourcing the design of motion subassemblies such as linear axes and multi-axis gantries. Whether a machine builder will design and build their own linear solution or specify and buy a made-to-order subassembly is determined largely by the amount of time available for design and the number of machines built using that design.

For long design cycles where many repeat machines will be built, machine builders can benefit from designing and building their own linear-motion solution. The long design cycle affords the time to find and specify the individual components of the axis — including the linear bearings, drive technology (ballscrew or belt, for example), support rails, carriage materials, and so on. This process lets machine builders optimize each component to meet a price-to-performance ratio and satisfy performance requirements for the machine at the lowest cost possible. Special attention must be paid to multi-axis solutions where complexity quickly increases with the number of axes. Combining and aligning axes, cable management, and moment loads in multiple directions are just a few of the additional considerations.

With shorter design cycles or when the number of machines built is lower, the economy of scale diminishes, and made-to-order subassemblies are a more practical solution. Without the time to optimize each component, or the financial return on investment of many repeat machine sales, a made-to-order subassembly is the quickest path to a successful design. The machine builder can be confident that the subassembly is built with high-quality components and can rely on the manufacturer to guarantee performance characteristics.

For multi-axis solutions, the manufacturer will have already designed the mechanical interfaces between axes, supplied a robust cable management solution, and calculated the various moment loads via their sizing software to ensure a high performing and cost-effective solution.

Laiewski: An increasing number of companies are losing experienced engineering talent and are struggling to find new talent for future growth. For this reason, more companies are now outsourcing the design and manufacturing of single or multi-axis subassemblies to specialists with the requisite core competencies. Linear and rod-style actuators are prime example of these types of subassemblies.

C. White: In-house engineering design and calculation services are increasingly in demand. Specific component suppliers typically have better software capabilities that are focused on their products. To create a competitive edge, companies are creating very specialized analysis tools to provide more accurate results and ensure the life of the product selected by the customer.

Electric and pneumatic linear actuators complement burgeoning forms of conveyance in automotive and electronics-manufacture — including linear transfer systems that allow the execution of automated assembly tasks directly on the transfer-system conveyance medium. Elsewhere, linear actuation boosts manufacturing with unbeatably accurate workpiece handling and positioning. Compactness is often a top objective for application-specific electric and pneumatic solutions.

O’Driscoll: Many industry segments use short and compact actuators, but these are key in automate machinery for packaging, light assembly, and electronics industries. Here, smaller machines and higher component density are prized.

Festo couldn’t achieve the desired space optimization while meeting ISO 6432 8 (25-mm bore single-rod) or ISO 21287 (compact sized 20 • 100-mm bore). While important for interchangeability, these two ISO norms essentially dictate components’ overall dimensions and mounting interface. As a workaround, Festo developed new space-optimized versions of two popular actuator types — DSNU-S round cylinders and ADN-S ultra-compact short-stroke cylinders.

The DSNU-S round-body cylinder is up to 40% more slender and 3.5 cm shorter than DSNU ISO types of the same bore size and stroke length … plus is lighter and allows direct mounting. Likewise, the ADN-S is up to 45% shorter and lighter than comparable Festo ADN ISO cylinders.

Both of these relatively new actuators (along with others in Festo’s Core range) are also now offered in the F1A version. This designation represents a line suitable for new applications such as lithium-ion battery cell production where content by mass of less than or equal to 1% copper, nickel, and zinc is required.

O’Driscoll: Along with optimizing machine footprints, it’s increasingly important for machine builders to reduce setup time and effort for machine commissioning.

Delicate applications have increasingly adopted use of linear actuation based on leadscrews; at the other end of the application spectrum, more position-intensive applications (and those needing exceptional power density) have spurred increased use of roller screw-based designs.

Beckstoffer: The emergence of biologics to provide therapy regimens for patients is driving development of new and differentiated drug-delivery devices. The utilization of a leadscrew to drive the syringe is becoming more popular for these devices. Coupled with a motor and gearbox, these customized drive systems perfectly fit the form factor required for patient comfort and mobility.

Mayr: The strong growth in roller-screw use is being driven by the emerging market for humanoid robotics. Specifically, roller screws offer the high power density needed to fit into space and weight-constricted designs. The same applies to the rotary joints that currently use strain-wave gearboxes for their space efficiency. Additional benefits can be realized by utilizing integrated force and torque sensors which provide highly accurate positioning feedback.

Rice: The strong growth in the use of roller screws is driven by the need for higher forces from linear axes. Ballscrews provide excellent force and accuracy performance but cannot reach the high forces available from larger pneumatic and smaller hydraulic actuators. Roller screws bridge the force gap in many applications, allowing machine builders to avoid the costs and maintenance requirements of compressed air and hydraulics.

Despite increased migration to electric-based linear motion, pneumatics remain indispensable.

O’Driscoll: Precision and compactness have become increasingly important in end user and machine builder applications. Reducing the weight and footprint of components while maintaining required performance is essential. The launch of Festo’s DGST offers the most compact slide on the market. In addition to precision, end-position accuracy, and high feed force, the DGST offers a new price competitiveness previously impossible with Festo’s past mini-slide portfolio.

Precision and accuracy were not synonymous with pneumatics in the past until the development of the mini-slide, also known as slide table in the market. With industrial and consumer goods leaning more and more on electronics, the need for compact, precise, and high-speed automation equipment has been growing year after year. Industries in light assembly, testing, and packaging all demand a mini-slide-type solution. After all, even when electric axes are used in handling systems, it’s still quite common to find pneumatics at the final positioning and gripping stages. Mini-slide functions include those for precision pushing, picking, insertion, and positioning tasks. Guided movements of small and large payloads (up to 17 kg) are possible with the DGST mini-slide due to twin piston actuation.

Unique to the DGST and the slide market is the way in which the yoke and slide plate are machined as one part. Prior to DGST, all mini-slides including Festo’s range were built with a two-piece assembly incapable of providing the accuracy today’s machine builders commonly demand. The new design provides the highest degree of precision.

The key point here is that many machine builders require a high level of dimensional control over parallel and perpendicular mounting surfaces of the mini-slides. When that dimensional control is not to the design requirement, machine builders resort to machining their own sub plates or shims — which in turn adds time and cost to projects.

Linear motion components often prove a more pragmatic choice than six-axis arrangements for roboticizing workcells in industrial settings. Surveyed market experts indicated there’s been increased use of use of Cartesian assemblies in place of manual operations for consumer, laboratory automation, and medical applications. Options abound, so engineers are cautioned to compare all specifications.

Palmer: The market for linear stages and linear motion systems has become highly competitive in recent years. There are many players in each region, all with relatively small market shares. Because design engineers specifying these products have so many options, and because the products typically consist of an assembly of standard linear motion products, it can be difficult to see any obvious differences between linear motion suppliers and their products.

However, as a design engineer it’s important to pay close attention to the details that may seem minor but ultimately have a large impact on the life and performance of the product. Some examples include polymer-bearing material properties, linear unit sealing solutions, linear rail sizes and specifications, load capacity and life ratings, repeatability, environmental ratings and certifications, and customizability.

Mayr: As demand for robots and cobots continues to increase, vertical and horizontal linear actuation kits are being developed to expand the reach of these robots … thereby making them more versatile while providing higher utilization rates.

Korkowski: We now offer linear-motion-based pick-and-place robots. These are customized with specific pick-and-place options — including force sensors, MagSpring-based load compensation, cleanroom certification to ISO4, and optional holding brakes. The robots are sustainable products that customers request as a single simple part number; they easily interface with our drives and reduce installation costs and maintenance as well. Now, we also offer electric linear-based gripper modules. Once design engineers add gripper modules to the pick-and-place robot, they have a complete automation solution … all with one-stop shopping.

Giunta: In the recent past, linear robotics and gantries were overlooked at a starting point for solving automation problems due to the popularity of six-axis robots. Most North American companies are evaluating automation for continuous-duty applications but are quickly finding the price of entry into this solution does not provide a fast enough ROI.

In contrast, gantry assemblies offer a lower price point, larger range of motion, and a higher payload capacity that six-axis robots for most pick-and-place applications.

Ikeuchi: IKO has teamed with AutomationWare to offer electric cylinders for longer travel and heavy load applications. What’s more, newer robotic joint modules allow for customized multi-axis robot configurations. Robot joint-specific J actuators and T actuators are available and have begun to gain adoption. What’s more, electric cylindrical actuators are available with a variety of options and short turnaround times — even with some customization. In addition, our precise low-profile miniature positioning stages, NT-V linear-motor, and servo or stepper-driven TM15 are seeing use in optical projects. Over the last year, IKO has also increased its ability to ship from U.S. inventory … and that helps support fast-paced development.

There is no substitute for the linear bearings that accompany linear drives.

Isaac: Certain linear bearings continue to be specified in linear-motion applications even with newer technologies available in the market. When looking at load capacity and speed compared to their cost, the benefits of both linear ball bushing bearings and plain bearings can outweigh other linear-guidance options. The added flexibility of material choices means these linear bearings can also be used in a range of applications across industries. As a result, we continue to see strong demand for these proven technologies.

Marques: As linear motors have become more popular, we’ve seen a lot of interest in our HepcoMotion GFX offering that features a hardened steel guidance system and uses high-speed high-precision Beckhoff linear motors. Many of the applications use variable speeds, multiple carriages acting in tandem, or programming the carriages to queue to optimize throughput and decouple processes with varying cycle times.

O’Driscoll: The market for guided drives is growing as more engineers become aware that it is easier and more convenient to buy a single product which combines the benefits of linear movement and guiding than buying both functions separately, the DFM from Festo is such a product.

Guided actuators are found in widespread use in applications involving lifting, pressing, pulling, pushing, clamping, stopping, restraining, holding, cutting, separating, and more. They come in many sizes and variants, can hold almost any tooling, deliver stroke lengths up to 400 mm, are extremely robust, and can apply great force where required.

From an industry perspective, guided actuators have widespread use in light assembly and handling, automotive Tier 1 applications, and the food and beverage industry. Guided actuators are suitable for literally any application that requires a linear actuator rigid enough to handle external torque or lateral loads.

The key to a guided actuator is ultimately the robustness. With DFM from Festo, design engineers get industry-leading rigidity and options to provide the right solution to satisfy the most critical requirements. If the need is based on high lateral or offset loading but price is a concern, then DFM offers a plain bearing guide solution, identified by GF in the type code. If superior stiffness and the least possible deflection is critical for positional accuracy, then DFM offers a recirculating ball bearing guide solution, identified by KF in the type code.

The key point here is that either way, both GF and KF versions are readily available in the DFM core range of standard strokes for quick delivery.

Growing emphasis on energy-efficient automation heavily relies on electric linear actuation, especially in home automation for control of lighting, HVAC, and smart-building functions, according to Grand View Research. Linear motion systems in mobile designs (including electric vehicles for motorized interior elements) have also driven demand for more efficient assemblies.

Marek: The linear motion market is seeing a surge in demand driven by the need for reliable and energy-efficient motion control across various industries. Material handling, factory automation, transportation, robotics and medical are just a few of the markets driving that demand.

Machinery and its subsystems connected through sensors and controls allow realtime monitoring of machine performance. This facilitates the harmonization these subsystems to drive optimum machine performance while providing datasets for predictive maintenance. Thomson has developed a family of smart electric linear actuators in increasingly higher power ranges that are rapidly replacing hydraulic, pneumatic, and manually operated axes on various types of machinery.

Meet the experts

Eric Rice | Product Market Manager – Electric Automation • Festo

Burnett Laiewski | Product Manager — Industrial Automation • Schaeffler Americas

Carl White | Engineering manager — industrial automation • Schaeffler Americas

Darren O’Driscoll | Product market manager — core products • Festo

Dave Beckstoffer | Industry manager • Portescap

Ulrich Mayr | VP — industrial automation • Schaeffler Americas

Matt Palmer | Product line manager – linear units • Thomson Industries Inc.

Mike Korkowski | Operations manager • LinMot USA

Michael Giunta | VP of sales and marketing • Macron Dynamics Inc.

Yugi Ikeuchi | General manager — engineering and app development • IKO Intl.

Charles Isaac | Product line manager – linear bearings and guides | Thomson Industries Inc.

Alex Marques | Product manager • Bishop-Wisecarver Corp.

Jim Marek | Senior director of engineering | Thomson Industries Inc.

Leave a Reply

You must be logged in to post a comment.