Pneumatic actuation has long been a tried-and-true motion method in many industries and applications. But today’s pneumatics companies are not your grandfather’s pneumatics – they are changing along with broader industrial and manufacturing trends, and continue to evolve their product offerings in line with new industry demands.

Fluid power actuation, like pneumatics, is not going away. But it is evolving. Case in point; servo pneumatics. As Frank Langro, Director of Product Market Management for Pneumatic Automation at Festo North America, points out, “the servo pneumatic application range has narrowed as the cost and ease-of-use of servo electrics has become more economical.” He cites the company’s Simplified Motion Series of low-cost electric actuators as an example of electric motion becoming interchangeable with pneumatics in simple two and three position applications.

Still, proportional pneumatic solutions are not going away. As Langro points out, “servo press, for example, is an area where servo pneumatics deliver the price and performance that is ideal for the application. Intelligent pneumatics such as the Festo flexible valve VTEM, which changes functionality via downloadable apps, utilizes servo pneumatic control in a host of various ways to provide OEMs with new solutions for improved performance.”

Pneumatics manufacturers are also seeing changing demand from different industries. Tim Sharkey, Director of Product Market Management for Electric Automation at Festo North America, says that he’s seen warehouse and distribution centers pushing the automation envelope. “Some of the motion innovations developed for warehouse/distribution will be useful in other applications benefiting from smart, flexible material handling and mobile automation,” says Sharkey. Examples of other applications include meat processing, especially with the effects of the coronavirus impacting worker density and the need to increase space between workers. The farm industry may also be on the cusp of further automation, although some significant technology hurdles remain, including motion, vision, AI, and cost issues.

There is also increased demand for miniaturization and even integration of feedback devices into many linear components, especially with the trend toward smart manufacturing. “Smart manufacturing implies that more information about the machine’s condition and operation is available,” says Langro. “With the Festo SDAT position transmitter, for example, the controller has data on the actual distance traveled by the cylinder. Minute changes in the length of extension may indicate that the cylinder requires maintenance or replacement, a part may be damaged, or the part does not meet quality specifications.”

Smart manufacturing capabilities like these contrast with a situation where there is no insight into a manufacturing process. Here, for instance, a maintenance technician at the end of a shift may have to examine a bad batch of product, trying to determine the root cause of a failure. With smart manufacturing, greater insight into processes can improve competitiveness.

What’s more, there’s a trend toward an increased demand for absolute encoders, spotlighting one of their key advantages; “during a power loss or with an external force applied, the system is capable of moving the load. The servo system will already know its position rather than performing a homing routine,” notes Sharkey.

The addition of a linear feedback device on the actuator plus one on the motor is another important development trend, Sharkey points out. The actuator-mounted device forms an outer feedback loop that can help detect a failure in the motor coupling or a break in the drive belt. By monitoring both the motor encoder and the feedback device on the actuator, an OEM will have redundant positioning feedback that can help ensure that the system is functioning properly. Feedback on the actuator, as well as on the motor, achieves higher positioning resolution and accuracy.

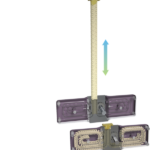

Furthermore, simply reading the position of the linear system on the motor fails to consider any backlash from the coupling, belt, or ball screw. “Festo, for example, developed a belt actuator that has an integrated linear feedback device,” adds Sharkey. “This actuator provides 2.5 microns of resolution and it gives OEMs the speed, low cost, and simplicity of a belt actuator with the precision of a more expensive and maintenance-intensive ball screw.”

There is also a move towards outsourcing the design of certain motion subassemblies, such as stages, gantries and X-Y tables. The reasons for outsourcing include economic and performance advantages, not to mention lowering risk. As Sharkey points out, “purchasing a motion subassembly frees the OEM to focus on its core competencies. For example, an OEM in the high-throughput biological-sample screening market is freer to explore the biology of high-speed screening when it does not have to allocate resources to developing a mechatronic system for handling sample vials. Subassembly suppliers are likewise incentivized to develop ever more effective stages, gantries, and XY tables. It is a win-win for both OEM and supplier.”

Handling the pandemic

The coronavirus pandemic has impacted every business in one way or another. We asked how the pandemic has effected Festo’s business and here’s what they told us.

Tim Sharkey, Director of Product Market Management for Electric Automation at Festo North America

COVID-19 has dramatically changed our presales process. We simply cannot visit customers and introduce them to new products the way we practiced pre-COVID-19. This is a challenging situation for field sales and applications engineers. We will have to develop new, effective means of serving customers during the new machine R&D cycle.

Frank Langro, Director of Product Market Management for Pneumatic Automation at Festo North America

To Tim’s point about the difficulty of introducing new products to customers, online design tools, which were already important pre-COVID-19, will become even more so. Within these tools, the newest solutions can be seamlessly integrated and introduced as well as describing new capabilities. Suppliers that offer an intuitive online design and ordering environment will gain a competitive advantage not only for themselves, but also for their OEM and end user customers. With Festo’s Handling Guide Online, for example, OEMs can design and order a single-axis system, linear gantry, planar surface gantry, or three-dimensional gantry in about 20 minutes. At the end of the design session, they will have a quotation for the system and CAD drawings. The pandemic served to speed up the trend toward the use and development of online parameterization tools.

Leave a Reply

You must be logged in to post a comment.